How to Choose a Life Insurance Policy

What Is Life Insurance?

insurance may be a contract between associate degree nondepository financial institution and a policy owner. A life insurance policy guarantees the insurer pays a total of cash to named beneficiaries once the insured dies in exchange for the premiums paid by the client throughout their lifetime.

The life insurance application should accurately disclose the insured’s past and current health conditions and insecure activities to enforce the contract.

KEY TAKEAWAYS

• insurance is a wrongfully binding contract that pays a benefit to the policy owner when the insured dies.

• For a life insurance policy to stay in force, the client should pay one premium up front or pay regular premiums over time.

Also Read: NETWORK MARKETING IS NOWADAYS

• once the insured dies, the policy’s named beneficiaries can receive the policy’s face value, or death benefit.

• Term insurance policies expire once a precise variety of years. Permanent life insurance policies remain active till the insured dies, stops paying premiums, or surrenders the policy.

• A life insurance is just nearly as good because the money strength of the corporate that problems it. State warranty funds might pay claims if the institution can’t.

forms of insurance

many alternative types of life insurance are obtainable to fulfill all sorts of desires and preferences. counting on the short- or long needs of the person to be insured, the key selection of whether or not to pick temporary or permanent life insurance is very important to consider.

Term life insurance

Term life insurance lasts a precise variety of years, then ends. you select the term once you put off the policy. Common terms are 10, 20, or thirty years. the simplest term life insurance policies balance affordability with long-term money strength.

• Decreasing Term Life Insurance—decreasing term is renewable term insurance with coverage decreasing over the lifetime of the policy at a planned rate.

• Convertible Term Life Insurance—convertible term life insurance permits clients to convert a term policy to permanent insurance.

• Renewable Term Life Insurance—is a yearly renewable term life policy that has a quote for the year the policy is purchased. Premiums increase annually and are sometimes the smallest amount costly insurance within the beginning.

Permanent life insurance

Permanent life insurance stays in effect for the insured’s entire life unless the policyholder stops paying the premiums or surrenders the policy. It’s usually dearer than term.

• Whole Life—whole insurance may be a form of permanent life insurance that accumulates money worth. Cash-value life insurance permits the client to use the cash value for several purposes, comparable to a supply of loans or cash or to pay policy premiums.

• Universal Life (UL)—a type of permanent life insurance with a cash value part that earns interest. Universal life options versatile premiums. not like term associate degreed whole life, the premiums are often adjusted over time and designed with A level benefit or an increasing death benefit.

• Indexed Universal (IUL)—this may be a form of universal insurance that lets the client earn a hard and fast or equity-indexed rate of come back on the money worth component.

• Variable Universal (VUL)—with variable universal life insurance, the policyholder can invest the policy’s cash value in an obtainable separate account. It additionally has versatile premiums and may be designed with A level benefit or an increasing death benefit.

Term vs. Permanent insurance

Term life insurance differs from permanent life insurance in several ways however tends to best meet the requirements of most people. Term insurance solely lasts for a group amount of your time and pays a benefit should the client die before the term has expired. Permanent life insurance stays in impact as long because the policyholder pays the premium. Another essential distinction involves premiums—term life is usually much more cost-effective than permanent life as a result of it doesn’t involve building a money value.

Before you apply for all times insurance, you ought to analyze your money state of affairs and verify what quantity money would be needed to take care of your beneficiaries’ customary of living or meet the requirement that you’re buying a policy.

For example, if you’re the first caretaker and have youngsters two and four years old, you’d wish enough insurance to hide your tutelar responsibilities till your kidren are grownup up and ready to support themselves.

you may analysis the price of hiring a nanny and a house servant or mistreatment industrial child care and a cleansing service, then maybe add some cash for education. embody any outstanding mortgage and retirement desires for your relative in your insurance calculation. particularly if the spouse earns considerably less or may be a stay-at-home parent. Add up what these prices would be over consequent sixteen around years, add a lot of for inflation, and that’s the benefit you may wish to buy—if you’ll be able to afford it.

Burial or final expense insurance is a form of permanent insurance that contains a little death benefit. Despite the names, beneficiaries can use the death benefit as they wish.

what quantity insurance to shop for

several factors can have an effect on the price of life insurance premiums. sure things could also be on the far side your control, however alternative criteria can be managed to probably bring down the price before applying.

once being approved for an insurance policy, if your health has improved and you’ve created positive life style amendments, you’ll be able to request to be thought of for change in risk class. though it’s found that you’re in poorer health than at the initial underwriting, your premiums won’t go up. If you’re found to be in higher health, then you can expect your premiums to decrease.

STEP one – verify what quantity you would like

believe what expenses would want to be coated within the event of your death. Things like mortgage, faculty tuition, and alternative debts, to not mention ceremony expenses. Plus, financial gain replacement may be a major issue if your relative or fair-haired ones would like income and aren’t ready to offer it on their own.

There are useful tools on-line to calculate the payment that may satisfy any potential expenses that may got to be covered.

What Affects Your insurance Premiums and Costs?

STEP two – Prepare Your Application

Investopedia / Lara Antal

• Age: this is often the foremost necessary factor as a result of anticipation is that the biggest determinant of risk for the insurance company.

• Gender: as a result of ladies statistically live longer, they typically pay lower rates than males of identical age.

• Smoking: someone who smokes is in danger for several health problems that would shorten life and increase risk-based premiums.

• Health: Medical exams for many policies embody screening for health conditions like heart sickness, diabetes, and cancer and connected medical metrics that may indicate risk.

• Lifestyle: Dangerous lifestyles can create premiums way more expensive.

• Family medical history: If you’ve got proof of major disease in your immediate family, your risk of developing sure conditions is far higher.

• Driving record: A history of moving violations or drunk driving will dramatically increase the price of insurance premiums.

insurance shopping for Guide

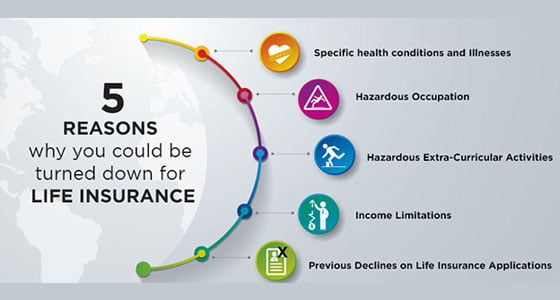

insurance applications usually need personal and family case history and beneficiary information. you may also probably got to suffer a medical exam. you may need to disclose any pre-existent medical conditions, history of moving violations, DUIs, and any dangerous hobbies comparable to racing or skydiving.

customary varieties of identification will be required before a policy are often written, comparable to your Social Security card, driver’ license, and/or U.S. passport.

STEP three – Compare Policy Quotes

once you’ve assembled all of your necessary information, you’ll be able to gather multiple insurance quotes from disagreeent|completely different} suppliers supported your research. costs can differ markedly from company to company, thus it’ necessary to travel to the trouble to search out the simplest combination of policy, company rating, and premium cost. as a result of life insurance are some things you may probably pay monthly for decades, it can save a vast quantity of cash to find the best policy to suit your needs.

Benefits of insurance

There are several advantages to having life insurance. Below are a number of the foremost necessary options and protections offered by life insurance policies.

the general public use life insurance to produce cash to beneficiaries who would suffer a money hardship upon the insured’s death. However, for affluent people, the tax advantages of life insurance, as well as the tax-deferred growth of money value, nontaxable dividends, and tax-free benefits, will provide extra strategic opportunities.

Avoiding Taxes—the death benefit of a life insurance policy is typically} tax-free.1 affluent individuals sometimes obtain permanent life insurance among a trust to help pay the estate taxes which will flow from upon their death. This strategy helps to preserve the worth of the estate for his or her heirs. minimisation may be a law-abiding strategy for minimizing one’s liabilities and may not be confused with tax evasion, that is illegal.

Who desires Life Insurance?

insurance provides funding to extant dependents or alternative beneficiaries once the death of associate degree insured policyholder. Here are some samples of those who may have life insurance:

• folks with minor children—if a parent dies, the loss of their financial gain or caregiving skills could produce a money hardship. insurance can ensure {the kids|the youngsters|the youngsters} will have the financial resources they have till they will support themselves.

• folks with special-needs adult children—for children who need womb-to-tomb care and can ne’er be self-sufficient, life insurance can make sure their desires are met once their parents pass away. The benefit are often accustomed fund a special needs trust that a fiduciary will manage for the adult child’s benefit.2

• Adults who own property together—married or not, if the death of 1 adult would mean that the opposite might no longer afford loan payments, upkeep, associate degreed taxes on the property, insurance could also be an honest idea. One example would be an engaged couple who put off a joint mortgage to shop for their initial house.

• Seniors who wish to depart cash to adult youngsters who offer their care—many adult children sacrifice time at work to worry for an older parent who desires facilitate. This help can also embody direct money support. insurance will help reimburse the adult child’s prices once the parent passes away.

• Young adults whose folks incurred non-public student loan debt or cosigned a loan for them—young adults while not dependents seldom would like insurance, however if a parent are on the hook for a child’s debt once their death, the kid might want to hold enough life insurance to pay off that debt.

• youngsters or young adults who want to lock in low rates—the younger associate degreed healthier you are, the lower your insurance premiums. A 20-something adult would possibly obtain a policy even without having dependents if there’s an expectation to own them within the future.

• lodge in home relatives – stay at home spouse ought to have life insurance as they need important quantity supported the work they are doing within the home. in step with Salary.com, the economic value of a lodge in home parent would are admire associate degree annual pay of $162,581 in 2018.

• affluent families who expect to owe estate taxes—life insurance will offer funds to hide the taxes and keep the total value of the estate intact.

• Families who can’t afford burial and ceremony expenses—a little insurance policy can provide funds to honor a fair-haired one’s passing.

• Businesses with key employees—if the death of a key employee, comparable to a CEO, would produce a severe money hardship for a firm, that firm might have associate degree interest which will permit it to buy a insurance policy on it employee.

• Married pensioners—instead of selecting between a pension payout that gives a spousal benefit and one that doesn’t, pensioners will favor to settle for their full pension and use a number of the money to shop for life insurance to profit their spouse. This strategy is termed pension maximization.

every policy is exclusive to the insured and insurer. It’s necessary to review your policy document belowstand|to know|to grasp} what risks your policy covers, what quantity it’ll pay your beneficiaries, and under what circumstances.

concerns Before shopping for insurance

analysis policy choices and company reviews—because life insurance policies are a significant expense and commitment, it’ essential to try and do correct due diligence to form certain the corporate you select contains a solid memoir and money strength, only if your heirs might not receive any benefit for several decades into the future. Investopedia has evaluated legion corporations that supply all differing kinds of insurance and rated the simplest in numerous categories.

Life insurance are often a prudent money tool to hedge your bets and supply protection for your fair-haired ones just in case of death must you die whereas the policy is in force. However, there are things within which it makes less sense—such as shopping for an excessive amount of or insuring those whose financial gain doesn’t got to be replaced. So, it’ necessary to think about the following:

What expenses couldn’t be met if you died? If your relative contains a high income and you don’t have any children, perhaps it’ not warranted. it’s still essential to consider the impact of your potential death on a relative and think about what quantity funding they’d got to grieve without fear about returning to figure before they’re ready. However, if each spouses’ financial gain is critical to take care of a desired life style or meet money commitments, then both spouses may have separate insurance coverage.

If you’re shopping for a policy on another family member’ life, it’ important to ask—what are you making an attempt to insure? youngsters and seniors extremely don’t have any purposeful income to replace, however burial expenses might need to be coated within the event of their death. on the far side burial expenses, a parent may also wish to guard their kid’s future eligibility by buying a moderate-sized policy once they are young. Doing thus permits that parent {to ensure|to create sure|to confirm} that their child will financially protect their future family. folks are solely allowed to buy insurance for his or her youngsters up to 25% of the in-force policy on their own lives.

might finance the money that may be paid in premiums for permanent insurance throughout a policy earn {a better|a far better|a much better|a higher|a stronger|a a lot of robust|an improved} come back over time? As a hedge against uncertainty, consistent saving and investing—for example, self-insuring—might make more sense in some cases if a big financial gain doesn’t need to get replaced or if policy investment returns on money worth are excessively conservative.

however insurance Works

A life insurance policy has 2 main components—a benefit and a premium. Term life insurance has these two components, however permanent or whole life insurance policies even have a cash value component.

1. Death Benefit—the death benefit or face value is that the quantity of cash the insurance underwriter guarantees to the beneficiaries known within the policy once the insured dies. The insured may be a parent, and therefore the beneficiaries might be their children, for example. The insured will select the required benefit quantity supported the beneficiaries’ calculable future needs. The insurance underwriter can verify whether or not there’s associate degree interest and if the projected insured qualifies for the coverage based on the company’s underwriting needs regarding age, health, and any dangerous activities within which the proposed insured participates.

2. Premium—premiums are the money the client pays for insurance. The insurer should pay the death benefit once the insured dies if the policyholder pays the premiums as required, and premiums are determined partly by however probably it’s that the insurer will have to pay the policy’s benefit supported the insured’s anticipation. Factors that influence life expectancy embody the insured’s age, gender, medical history, activity hazards, and insecure hobbies.3 a part of the premium additionally goes toward the insurance company’s operative expenses. Premiums are higher on policies with larger death benefits, people who are at higher risk, and permanent policies that accumulate money worth.

3. money Value—the cash value of permanent insurance serves 2 purposes. it’s a bank account that the client will use throughout the lifetime of the insured; the cash accumulates on a tax-deferred basis. Some policies might have restrictions on withdrawals counting on however the money is to be used. For example, the client might put off a loan against the policy’s cash worth and ought to pay interest on the loan principal. The policyholder can even use the cash value to pay premiums or purchase extra insurance. The cash value may be a living profit that continues to be with the insurance underwriter once the insured dies. Any outstanding loans against the cash value can cut back the policy’s death benefit.

however does one Qualify for all times Insurance?

insurance is offered to anyone, however the price or premium level will vary greatly supported the chance level a personal presents based on factors like age, health, and lifestyle. insurance applications usually need the client to produce medical records and case history and suffer a medical exam. Some forms of life insurance comparable to bonded approval life don’t require medical exams but generally have a lot of higher premiums and involve an initial waiting amount before taking impact and giving a benefit.

however will insurance Work?

insurance policies all provide a death benefit in exchange for paying premiums to the insurance supplier throughout the term of the policy. One standard form of insurance—term life insurance—only lasts for a group quantity of time, comparable to ten or twenty years during that the client must offset the money impact of losing income. Permanent life insurance additionally options a benefit however lasts for the lifetime of the policyholder as long as premiums are maintained and may embody money worth that builds over time.